Why Chess Improvement Feels Clean — and Trading Doesn’t

(And How to Trade Like You Play Chess)

I recently got into chess — and got hooked.

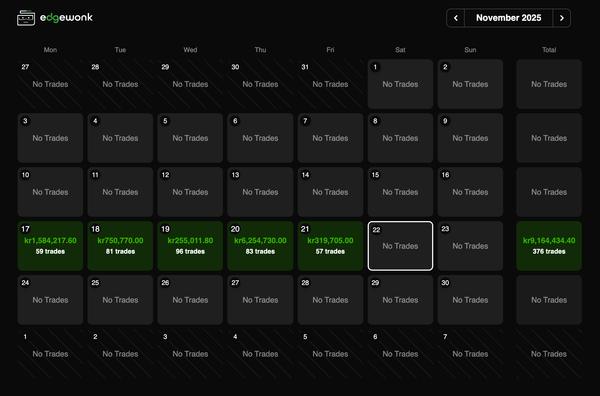

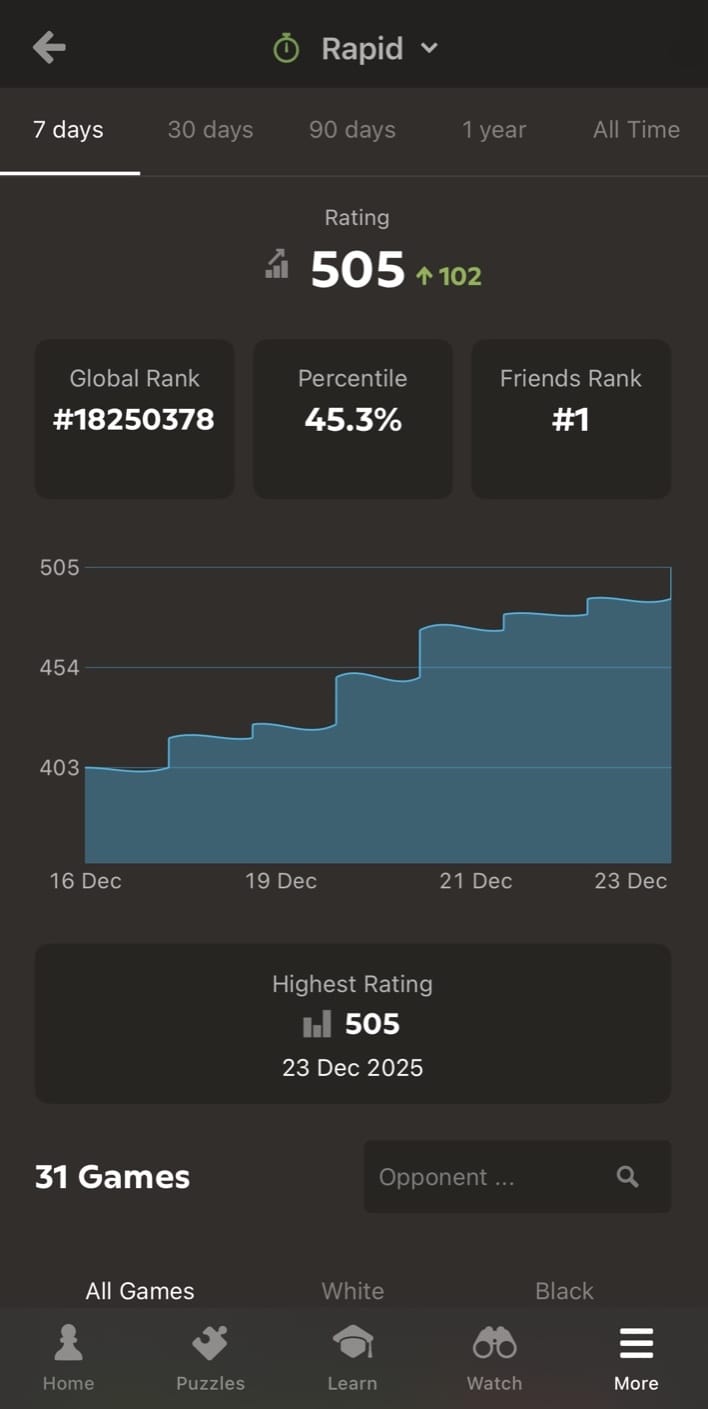

My chess rating has been climbing steadily. The graph looks clean. Predictable. Almost reassuring.

My trading equity curve, on the other hand, has never looked like that — even during periods of real improvement.

At first glance, it’s tempting to draw the wrong conclusion:

“I’m better at chess than trading.”

That conclusion is wrong.

The difference has very little to do with skill.

It has everything to do with environmental fairness.

Why Chess Progress Feels Clean

Chess is a closed system.

- Same board

- Same rules

- Same starting position

- No regime shifts

- Immediate, unambiguous feedback

If you blunder, you lose.

If you make a strong move, your position improves.

There is no ambiguity.

No “this worked but shouldn’t have.”

No delayed or noisy feedback.

Crucially, there is also no money and no identity threat.

The nervous system stays calm.

No cortisol.

No survival response.

Each game deposits learning into long-term memory.

Nothing is taken away by randomness.

The brain sees a clean loop:

Cause → Effect → Improvement

Of course the graph goes up.

Why Trading Does Not Feel Like That (At First)

Trading violates almost every one of those conditions.

It is:

- An open, adversarial system

- Subject to regime shifts

- Random in sequence

- Probabilistic, not deterministic

Feedback is delayed and often misleading:

- A good trade can lose

- A bad trade can win

Outcomes lie constantly.

Add money to the equation and the nervous system is hijacked:

- Loss feels like threat

- Win creates dopamine rush

- Both distort perception

In trading, execution is not a knowledge problem.

Most traders already know what to do.

The gap is whether they can do it under pressure.

That’s why trading progress feels jagged, unfair, and slow — even when it’s real.

The Critical Reframe

My chess improvement proves something important:

When feedback is clean and identity is not threatened, skill compounds quickly.

So the takeaway is not:

“I wish trading was easier.”

The correct takeaway is:

“My job in trading is to make my environment feel as predictable and rule-bound as chess.”

That is exactly what pro traders spend years doing:

- Pre-planned execution

- Environment recognition

- Stand-down rules

- Removing hope and rescue attempts

- Treating missed trades as non-events

All of this is an attempt to turn trading into a chessboard.

The Hard Truth

You don’t want trading to be easy.

You want it to be emotionally neutral.

Chess isn’t rewarding because it’s easy.

It’s rewarding because nothing inside you is being threatened.

The real work is not:

- More edge

- More setups

- More size

The real work is:

- Removing everything that makes trading feel unlike chess

When that happens:

- Progress stops being tied to daily PnL

- Execution becomes automatic

- Trading at size feels normal instead of threatening.

♟️ How to Trade Like Playing Chess

1. Core Principle

I do not try to make markets behave like chess.

I make my role as a trader behave like a chess player.

Chess feels manageable because the player’s job is narrow, defined, and emotionally neutral.

That is my objective in trading.

2. The Board Is Defined Before the Game

Chess

- The board is fixed

- The pieces are known

- The rules never change

Trading

I must freeze the board myself before the session.

My board consists of:

- Decision zones

- Key levels

- Environment classification

- Setups I will trade

- Maximum risk exposure

- Stand-down conditions

If it is not defined before the session, it does not exist.

I do not invent zones mid-game.

I do not invent trades mid-session.

3. Legal Moves Only

Strong chess players don’t consider every move.

They consider 2–4 candidate moves that fit the position.

Trading is the same.

I also have only legal moves — predefined setups that fit the environment.

If a trade is not in that universe, it is an illegal move.

Illegal moves are not brave.

They are emotional reactions disguised as initiative.

4. Openings, Middlegame, Endgame

Opening → Pre-Market Preparation

What can be prepared:

- Zones

- Expected behaviour

- Likely environments

- Known structures

This is preparation, not prediction.

Middlegame → Live Reading of Structure

What cannot be pre-known:

- Momentum

- Zone reaction - Acceptance or Rejection

- Who is in control now

Like chess, this phase is about:

- Structure

- Balance

- Pressure

- Timing

I respond to the board. I do not force plans.

Endgame → Trade Management & Stand-Down

This is where professionals separate themselves:

- Press when winning

- Simplify when ahead

- Do not fight lost positions

Standing down is not fear.

It is grandmaster behaviour.

5. Execution: Thinking Is Forbidden at the Trigger

In chess, once you touch the piece, the move is made.

In trading:

- All decisions are made before the trigger

- When the trigger appears, I execute

Thinking during execution is the equivalent of recalculating after touching a chess piece.

The damage is already done. The opponent will see your weakness and punish you.

6. Losses: Respect the Opponent

In chess, I accept losses when:

- The opponent is stronger

- The position favours them

- I am outplayed

I do not take this personally.

Trading is no different.

Some days:

- The regime is hostile

- The sequence is unfavourable

- There is no edge to press

That is not failure.

That is opponent strength.

Replacing

“I failed today”

with

“The market played better today”

protects identity — and keeps learning intact.

7. Outcome Irrelevance

Only the winner gets the title in chess.

But strong players do not train by outcome. They ask:

- Was this move correct?

- Was this plan sound?

- Would this decision survive repetition?

Trading is no different.

Money matters. PnL is real.

But PnL is the scoreboard, not the coach.

A losing trade can be a perfect decision.

A winning trade can be a mistake.

Decision quality is the score.

8. Standing Down = Resigning a Lost Position

Strong chess players resign early.

Weak ones fight dead positions and get crushed.

In trading:

- No edge

- No intent

- No follow-through

- Multiple failed ideas

There is no good move.

Standing down is not punishment.

It is strategic resignation.

9. The Identity Shift

I am not here to:

- Make money today

- Recover losses

- Prove skill

- Chase moves

I am here to:

- Play the position in front of me correctly

Money is a long-term side effect of:

- Correct decisions

- Repeated over time

- In favourable environments

When trading feels boring, neutral, and procedural —

I am doing it right.

10. The Only Closing Question That Matters

At the end of every session, I ask:

“Did I play the position correctly, given the board I had?”

Not:

- Did I make money?

- Did I miss a move?

- Did I feel good?

Just:

- Was my play correct?

That is how progress compounds.

Final Thought

Chess works for me because:

- No identity threat

- No emotional narrative

- No outcome obsession

Trading only becomes the same when those elements are removed.

I don’t need trading to be easier.

I need my role inside it to be calmer, narrower, and cleaner.

When I trade like I play chess:

- Losses teach instead of wound

- Missed moves don’t haunt

- Standing down feels intelligent

- Size becomes irrelevant

- Confidence grows from execution, not PnL

This is how pro traders operate.